Complaints about banking fraud and scams have hit an all-time high in the past two financial years, according to the UK’s Financial Ombudsman Service, prompting campaigners to claim that financial fraud is escalating out of control. Over 12,000 customer complaints about financial fraud were logged with the ombudsman in 2018/2019, an increase of 40 per cent. Because of the clandestine nature of money scandals, it is difficult to catch and nip the scams in time.

In India, we also saw high number of scams. Nirav Modi Bank scam; this bank scam is being called the biggest scam (Rs 11,400 crore) in the banking sector of India. Vijay Mallya bank scam (Rs.9, 432 crore from 13 banks till February 2018). Allahabad Bank Scam – the Kolkata-based Allahabad Bank has said it has an exposure of ₹2,363 crore in the PNB fraud case.

The Volcker Rule is a federal regulation that generally prohibits banks from investing with their own accounts and limits their dealings with hedge funds and private equity funds, which are also called covered funds. The Volcker Rule aims to protect bank customers by preventing banks from making certain types of speculative investments that contributed to the 2008 financial crisis in West. The Volcker Rule relies on the premise that these speculative trading activities do not benefit banks’ customers.

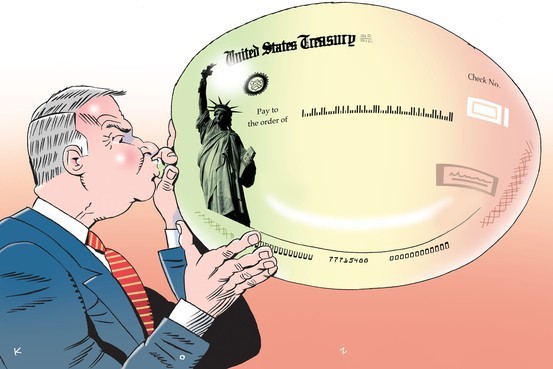

In August of 2019, the Office of the Comptroller of the Currency (the office of the Comptroller of the Currency is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863) voted to amend the Volcker Rule in an attempt to clarify what securities trading was and was not allowed by banks. The change would require five regulatory agencies to sign off before going into effect, but is generally seen as a relaxation of the rule’s previous restriction on banks using their own funds to trade securities.

History of the Volcker Rule: It’s named after Paul Volcker – the former Federal Reserve Chairman. Paul Volcker died on December 8th, 2019 at the age of 92.

The Volcker rule also bars banks, or insured depository institutions, from acquiring or retaining ownership interests in hedge funds or private equity funds, subject to certain exemptions. In other words, the rule aims to discourage banks from taking too much risk by barring them from using their own funds to make these types of investments to increase profits. The Volcker Rule relies on the premise that these speculative trading activities do not benefit its customers.

The rule went into effect on April 1, 2014, with banks’ full compliance required by July 21, 2015; although the Federal Reserve has since extended time to transition into full compliance for certain activities and investments.

The rule, as it exists in US, allows banks to continue market-making, underwriting, hedging, trading in government securities, engaging in insurance company activities, offering hedge funds and private equity funds, and acting as agents, brokers or custodians. Banks may continue to offer these services to their customers to generate profits. However, banks cannot engage in these activities if doing so would create a conflict of interest. Depending on their size, banks must meet varying levels of reporting requirements to disclose details of their covered trading activities to the government.

In February 2017, U.S. President Donald Trump signed an executive order directing then-Treasury Secretary Steven Mnuchin to review existing financial system regulations. Larger institutions must implement a program to ensure compliance with the new rules, and their programs are subject to independent testing and analysis. Smaller institutions are subject to lesser compliance and reporting requirements.

Many critics have pointed out that regulations like the Volker Rule limit the growth of banks. They remain smaller and more focused on specific services. While this does restrict banking industry’s area of business, it does help eliminate the “too-big” part of “too-big-too-fail.”

India is different: The 2008 crisis gave birth to a new tag — ‘too big to fail’, which means that certain banks and financial institutions are so critical to the economy that the Government should come to their rescue when they are in danger of toppling over. Luckily, the impact of the 2008 crisis hit India at a macro level and not at the individual bank level. Banks in India did take a hit but it was too small to make them collapse. In keeping with the Indian culture of conservatism, the Reserve Bank of India (RBI) has issued Prudential Norms for classification, valuation and operation of the investment portfolio by banks in India.

The Volcker rule will not apply to India and not impact banks and financial institutions materially. However, the RBI could probably take a cue from the Volcker Rule and insist on a compliance certificate from the top management for trading activity. This certification makes it easier to nail banks when things go wrong. The functioning of the Volcker Rule ensures security for the taxpayer’s money. It is important for two reasons. The first is the sanctity of the ethos behind intermediation (matching of lenders with savings to borrowers) needs to be preserved. The purpose of intermediation is to channel funds from savers to borrowers, and banks have superior knowledge and analytical tools to bridge information irregularity to evaluate borrowers. The second is more ideological in nature why should they concentrate only on core lending because the origin of Volcker rule was that the sub-prime financial crisis occurred when banks sold too many mortgages to feed the demand for mortgage-backed securities which they sold through the secondary market.